BS/2 introduced its updated software solutions to leading Cambodian banks. In April 2024, the sales team visited Phnom Penh to meet with the partner of First Cambodia Co., Ltd and representatives from local financial institutions. Most of the discussion focused on ATMeye.iQ New Generation features. These include customer dispute resolution functionality, synchronization of ATM files with the server, and integration of various ATM sensors with Teltonika GPS trackers.

At the visit, BS/2 specialists conducted advanced training for First Cambodia on ATMeye.iQᴺᴳ advantages. They also showcased partner other company software solutions, such as Payments.iQᴺᴳ, Cash Management.iQ, and DS Center.iQ.

Cambodian Banks Place a High Priority on Customer Service

Cambodia has a developed banking infrastructure. Over 60 banks are represented in the country, and about 5,000 ATMs with various functions are here.

BS/2 and First Cambodia have been partnering since 2013. As a result of the collaboration 15 local banks already use ATMeye.iQ software.

During the visit, the joint delegation demonstrated BS/2 software solutions to bank managers. So, a few banks may start ATMeye.iQᴺᴳ’s pilot projects in 2024.

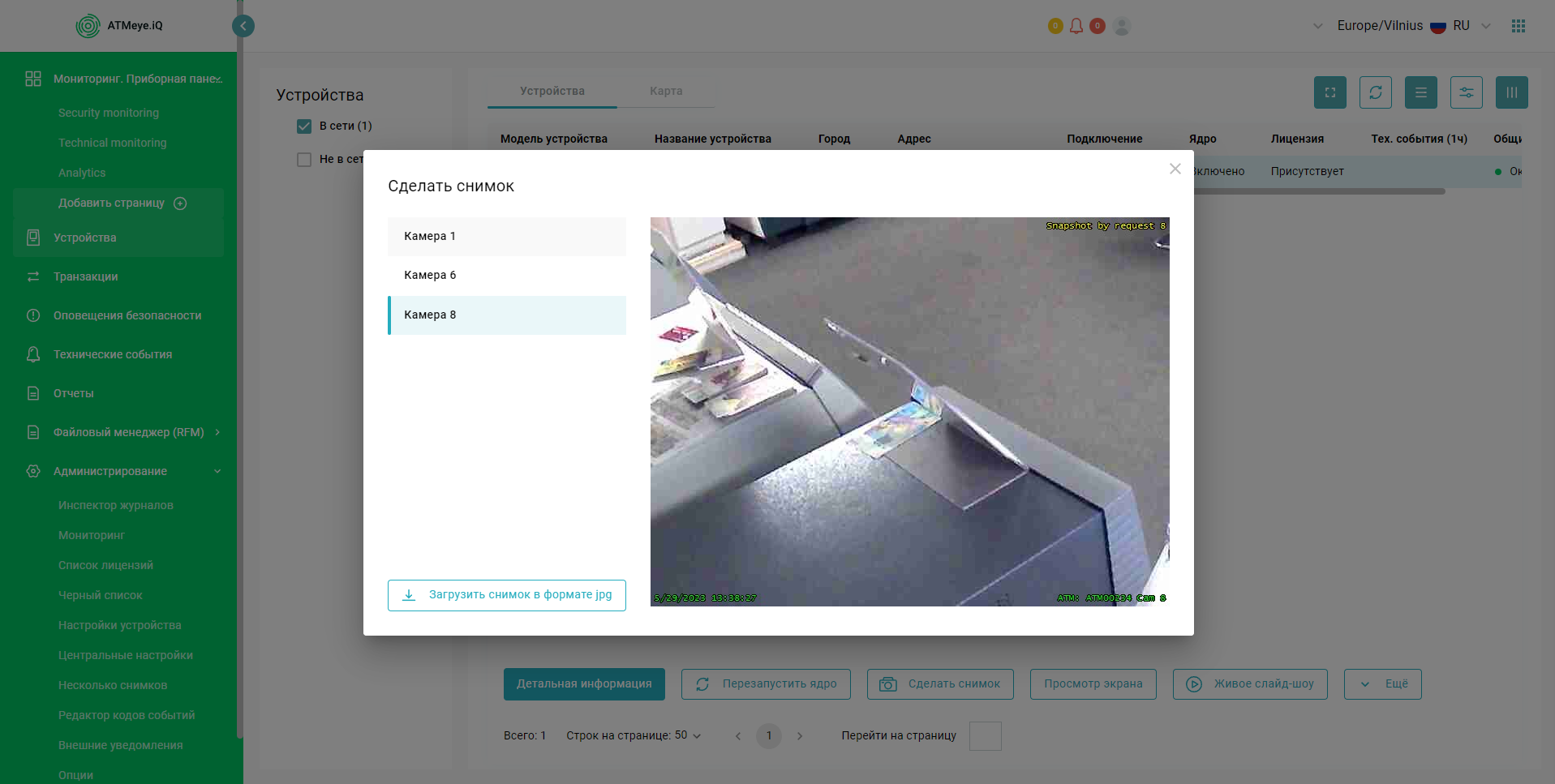

Bankers were most interested in compliance handling functionality. Dispute resolution in Cambodian banks can take two weeks to a month. The ATMeye.iQᴺᴳ records both photos and videos of each transaction stage. The system allows authorized users to generate detailed reports with two clicks for easy analysis and monitoring. Thus, banks have a complete toolkit in one solution to quickly resolve customers’ complaints.

The ATMeye.iQᴺᴳ Functionality is in Demand in Southeast Asia

ATMeye.iQᴺᴳ 1.8.0 was released in Q1 2024. There have been significant changes, including the integration of ATM sensors with Teltonika GPS trackers. Cambodian banks valued the ability to monitor ATMs even when the power or network is off.

The BS/2 experts also discussed the sync function of ATM files with the server. ATMeye.iQᴺᴳ enables automatic upload of sensitive information (log files, photos, videos, etc.) from the device to the server at any convenient time. Thus, the local ATM storage will always have available space as well as data will be protected.

Other BS/2 software products were also outlined at the meetings, including Cash Management.iQ, DS Center.iQ, and Payments.iQᴺᴳ with QR Pay module. Currently, Cambodia aims to move towards cashless transactions. The QR code payment method is extremely popular in the country, especially in the service industry.

Knowledge for Effective Customer Engagement

First Cambodia employees were actively involved in demonstrating software products to potential customers. Training on BS/2 software solutions allowed partners to apply new tools and knowledge at once.

Vladimir Alekseev, Head of BS/2 Software Sales Department:

“The modularity of BS/2 software solutions is one of its main advantages. ATMeye.iQNG has been developed with a flexible licensing system. Using this approach, different software modules can be implemented separately, based on company business goals.

If a customer is only interested in Remote File Management (RFM) functionality, BS/2 can provide a license only for this feature. Thus, customers can choose the products they need and optimize costs”.

Banks in Cambodia have a wide range of ATM models in their fleets. For the meeting participants, it was important to know that ATMeye.iQᴺᴳ, Cash Management.iQ, and other BS/2 products are compatible with various manufacturers (Diebold Nixdorf, NCR, GRG, etc.).

Financial organizations can improve their business processes and provide excellent customer service by deploying unified software across their entire ATM fleet.

Sign up for our free online ATMeye.iQᴺᴳ presentation! The BS/2 team is ready to share with you all the software benefits!