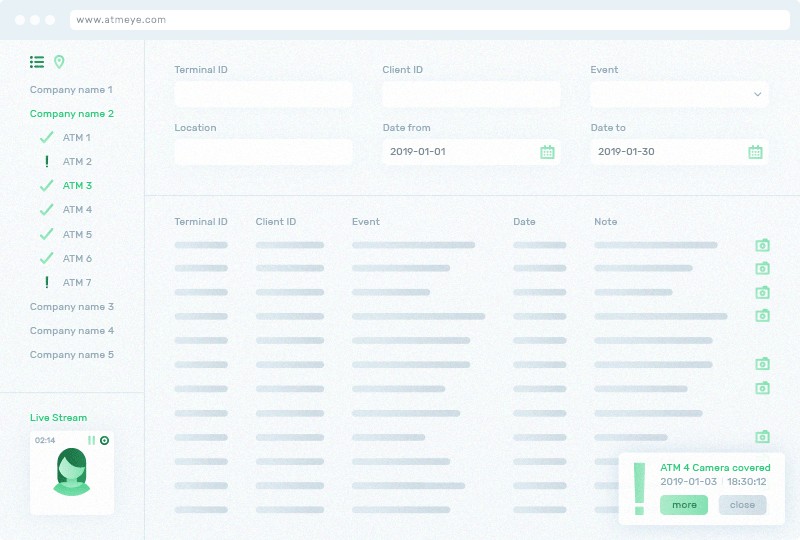

ATM Management System

Real time ATM monitoring and transaction analytics allows managers and tech teams to look deeper into network availability issues, security and failed customer interactions. It provides answers to why incidents are happening, analyzes their frequency, creates alerts and resolves issues more quickly.

The ATMeye.iQ ATM Management System offers uninterrupted, fast, and reliable link-up with all banking systems to actively ensure client satisfaction. The ATMeye.iQ ATM Management System can be linked to an unlimited number of terminals, in theory. In addition, you can use the system with devices of any manufacturer, installed anywhere in the world and remotely from each other. After all, IT solutions from ATMeye.iQ contribute to the stable operation of monitoring and control systems 24/7 in all situations.

ATMeye.iQ uses state-of-the-art solutions and technologies to ensure absolute control and security of ATMs:

- 24/7 audio, photo, and video recording

- Monitoring of indicators by built-in sensors

- Automatic notification system in case of non-compliance

- Protection against the installation of readers and the use of blacklisted cards

- Automatic software updates and more