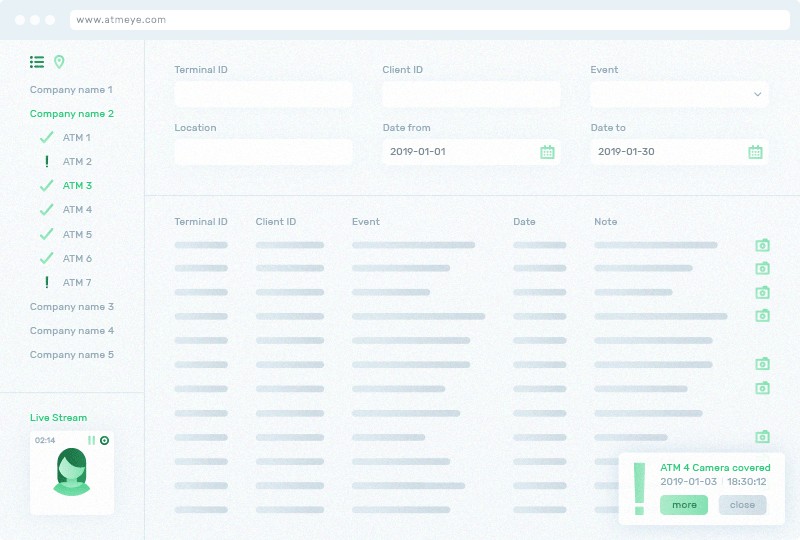

Comprehensive monitoring

ATMeye.iQ is used for video surveillance of ATMs, postal machines, electronic cashiers, terminals and other equipment. The solution is designed to monitor incidents, linking each transaction to the user, facilitating the resolution of disputes and providing protection against criminal activity.