Detect and prevent ATM fraud.

ATMeye.iQ is an ATM anti fraud software with real time video analysis, ATM anti skimming devices, facial detection and various sensors.

ATMeye.iQ is an all-in-one ATM security, dispute handling, and anti-fraud solution developed by BS/2, a software ATM security company, for banks and financial institutions. BS/2, part of the Penki Kontinentai Group has been the partner of Diebold Nixdorf in 13 countries for over 25 years.

BS/2 complies with strict financial industry regulations such as ISO-27001, ISO-20000, PCI-DSS, PA-DSS, EcoVadis Silver and ITIL V3.

ATMeye.iQ is an ATM anti fraud software with real time video analysis, ATM anti skimming devices, facial detection and various sensors.

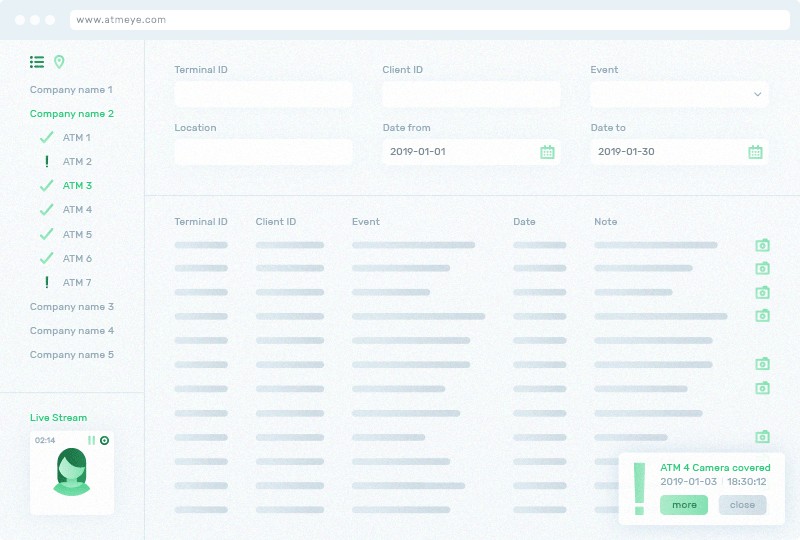

With advanced payment fraud detection, ATMeye.iQ ties every transaction to the ATM user. Effortlessly retrieve event footage from the card slot cam or any other integrated cam, simply searching by card number.

When various sensors detect malicious activity an immediate alert is sent . Security operators respond to threats or robberies with one click by launching configurable scenarios.

The system takes photo snapshots and captures video of all actions performed by a client at a self-service device. It allows building a detailed report of all events of any transaction.

The system takes photo snapshots and captures video when sensor triggers an event. It allows building a detailed report for all alarm events coming from the sensors.

Possibilities to take photo snapshots and capture video before and after events occur.

An opportunity to get instant access to streaming video and camera images from a particular self-service device.

On demand check of the status and setup configuration of self-service devices cameras can be performed with multiple snapshots function.

Capture photo and video in all relevant zones: card reader, cash dispenser, safe, client’s face and outside area of self-service device.

Cameras setting parameters can be switch from day to night mode according to the predefined schedule. It allows getting high quality images all day round in different outside conditions.

Determine whether there is a person in front of an ATM during an operation and whether his face is covered.

Determine whether there is more than one person in front of an ATM.

ATMeye.iQ supports all types of sensors (shock, vibration, tilt, smoke or temperature detectors) as well as special anti-fraud devices.

Responsible security officers are able to get immediate notifications (alarms) on sensor’s triggered events.

Relevant personnel can receive immediate notifications in case of covered cameras.

Emergency messages about any abnormal situations can be sent in real-time to mobile devices via the Mobile ATMeye.iQ application.

Event notifications are automatically sent to the responsible staff avoiding routine event stream analysis and reducing the reaction time.

A blacklisted bank card might be captured by a self-service device if needed. Responsible staff will be notified about such an event by an instant message.

The system allows configuring cameras remotely, choosing the best operation mode (day or night), setting brightness, contrast and other parameters.

All data transfers in the system run using encrypted protocol through the protected communication channel, securing any card data.

The integration with RFM.iQ allows the system to transfer files between remote self-service devices, administrator workstation and collection server.

Software updates is done remotely and centrally for the whole self-service device network without the need to physically come to the SDD.

The system allows transferring data and archiving photos, videos and logs according to the predefined schedules or preset algorithms.

Get a complete picture of the operation of the entire fleet of self-service devices.

Find devices and events using the easy to use search field.

A system operator receives information about current operating status of all self-service devices in the network. It allows him to react faster in case of technical problems.

Key card information (card number) is masked in ATMeye.iQ system, ensuring the complete safety of the client’s personal data.

Deployed in over 80 countries, ATMeye.iQNG is not only a unique and reliable solution but also an affordable one.

Helping your security and support personnel save time and resources. Minimizing your area of exposure, significantly reducing risk and helping you comply with industry standards and regulations.

What is the value of your clients security?