Financial institutions across the globe lose up to 5% of their annual revenue each year due to illegal actions on self-service devices. With face detection technology, banks can significantly reduce losses by detecting customers’ faces as they interact with ATMs.

BS/2, an international company within the Penki Kontinentai Group, announced an updated FD.iQ (Face Detection) module. Based on artificial intelligence technologies, the software ensures high face detection accuracy in front of ATM displays. The solution is available for ATMeye.iQ software.

Contents

Ensured Photos Quality

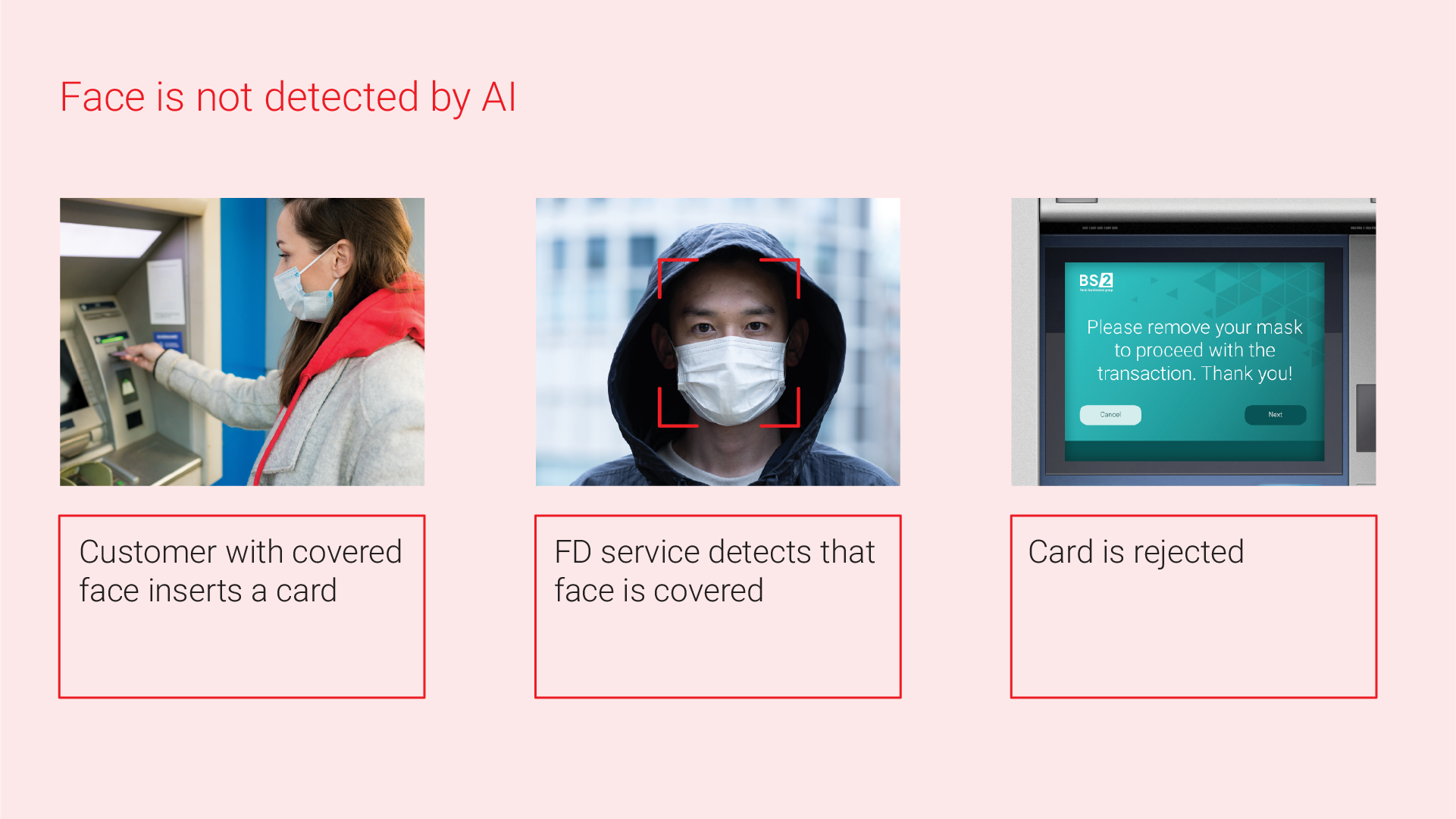

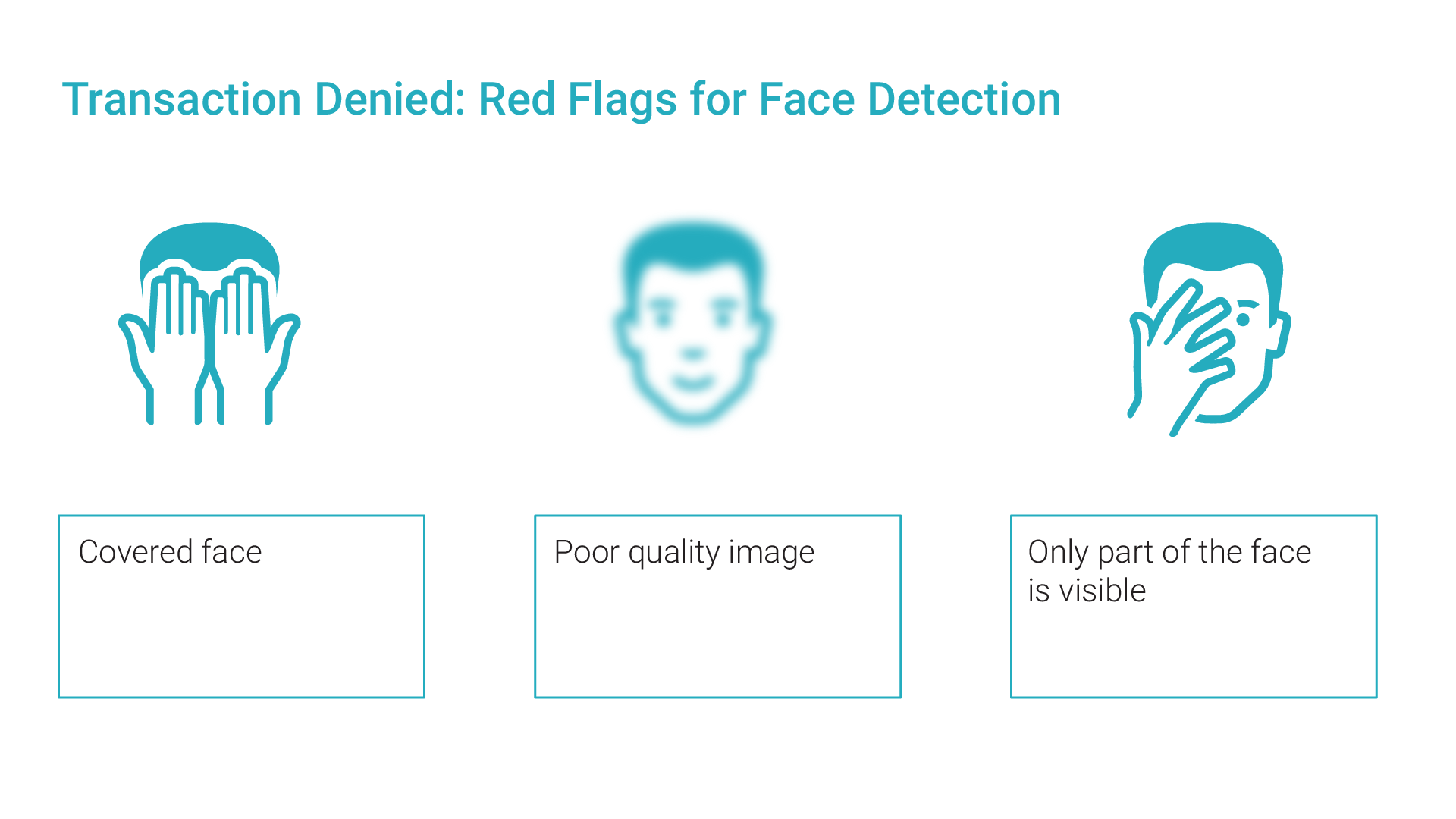

The FD.iQ software checks whether faces are well-lit, covered with helmets, or other objects, and whether customers are directly looking at the camera. So, the solution ensures high-quality images are taken while using the ATM. The transaction will not proceed if the face in the photo does not meet the requirements.

Siarhei Kraiko, Head of Software Product Development Department at BS/2:

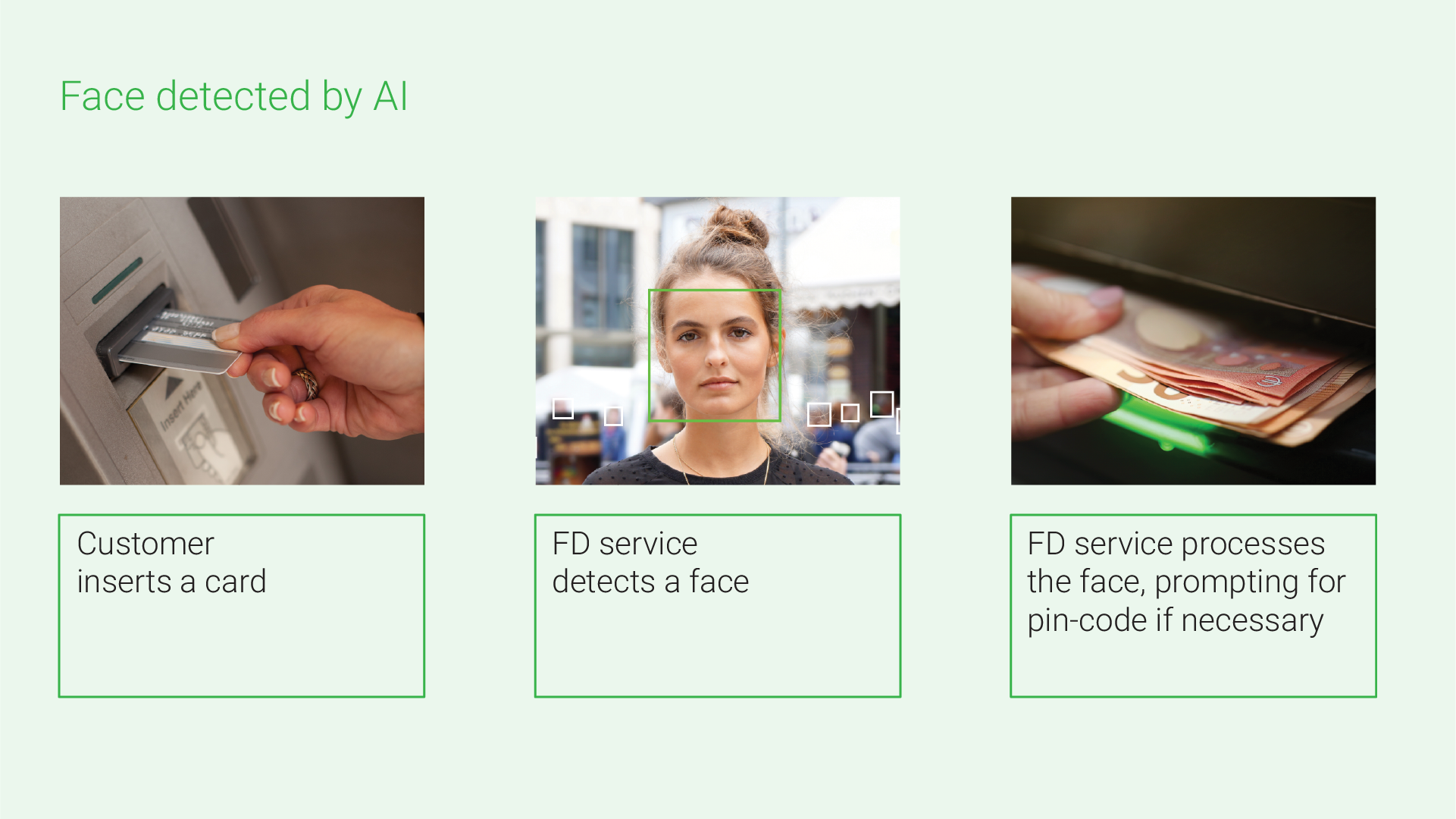

“When a customer approaches an ATM, the camera captures their image. As the user interacts with the device, the FD.iQ module uses neural networks to analyze the image. The transaction can proceed if the customer’s face is clearly visible and not covered.

Face Detection is integrated into the ATMeye.iQ monitoring and dispute resolution software. This system automatically alerts the bank to any suspicious activity at the ATM, such as repeated attempts to use the machine with a covered face“.

Cost-Effective Modernization and Rapid Deployment

One of the key advantages of the FD.iQ module is its lack of additional hardware requirements. Neither a separate server nor new video cameras are required for installation of the software solution. Face Detection can be quickly implemented into the bank’s existing ecosystem and ensures uninterrupted ATM operation without long downtimes.

Scalability and Customization

Using FD.iQ (Face Detection) software, customers can customize image requirements based on their region and individual demands. The functionality is optimized for bright sunlight and darkness in Africa, ensuring high-quality photos even in difficult lighting conditions.

Andrius Araminas, Head of Sales, ATMeye.iQ at BS/2:

“Our software product is easily scalable according to bank requirements. FD.iQ functionality was customized for a customer in Africa due to regional specificities, including extreme lighting conditions. Direct sunlight during the day and the dark skin tones at night in the evening make the detection process challenging. AI trained on hundreds of thousands of self-sourced photos can recognize different situations accurately, such as the wearing of masks, helmets, scarves, etc.

Due to the software’s flexibility and adaptability, banks can tailor the system to fit local requirements. For example, Face Detection can spot traditional headgear that covers the face.”

In some cases, the system allows a person to use the ATM while wearing sunglasses or with a group of people. However, the software can be configured to automatically block transactions in such situations at the customer’s request. BS/2 specialists can customize the solution quickly to meet all customer’s needs.

In addition to Face Detection, the Face Recognition feature can be implemented on Smart ATMs. The primary difference between these solutions is that FD.iQ determines whether a customer’s face is visible, while Face Recognition provides accurate and automatic identification based on biometric data.

One of the key benefits of implementing Face Recognition on self-service devices is the ability to create and manage blacklists and whitelists.

Blacklists include personalities whom the bank considers potential threats, such as users suspected of fraud or other illegal activities. When the system recognizes such a user at an ATM, it can automatically block access to transactions and alert security staff for immediate action.

Whitelists, conversely, contain individuals the bank fully trusts, such as bank employees or VIP clients. When someone from the whitelist is recognized, the system automatically grants access to advanced features or streamlines the authentication process, significantly speeding up service and enhancing customer loyalty.

Face Detection Benefits for Banks:

- Enhancement of ATM Security

- Fraud Prevention

- Faster Investigation of Incidents

- Regulatory Compliance*

- Providing Useful Data to Law Enforcement

- Verification and Protection in Real-Time

*Many countries (Germany, France, Nigeria, India, USA, etc.) require that ATMs should be equipped with photo and video surveillance devices. All ATM activities must be monitored and recorded by the cameras. As a result, these measures improve security, prevent fraudulent activities, and, if necessary, assist law enforcement agencies.

FD.iQ and ATMeye.iQ represent the next step in developing technology to enhance the security of self-service devices. In addition to providing high-quality photos, the solution offers cost-effective integration and flexible customization for different environments and customer requirements. These benefits enable banks to be confident that their security systems are reliable and effective.

Sign up for a free presentation to learn more about the Face Detection features!