BS/2 presented its updated products for the first time at the IV International PLUS-Forum “Fintech Borderless. Digital Eurasia” in Kazakhstan.

Forum participants learned how modern software solutions can improve customer experience and banking security, as well as increase bank profits.

Contents

BS/2 is a sponsor and partner of one of the largest events for the financial sector in Central Asia

The Forum program covered topics related to the further development of fintech, government services, E-commerce, and payment business. The conference was attended by more than 1 600 international and regional experts. More than 1 600 applications were submitted from more than 36 countries.

BS/2 sponsored the Forum in Almaty and has its largest subsidiary in Central Asia with more than 80 employees and 24 branches throughout the country.

Bank software solutions for efficient work

The BS/2 promotes advanced new generation software solutions in the banking sector, such as ATMeye.iQ and Payments.iQ. Previous versions of the products are well known in Kazakhstan’s banks.

JSCB “Kapitalbank” in Uzbekistan implements a new generation of ATMeye.iQ software on its self-service devices. Kirill Ovsiannikov, Deputy General Director for Strategic Development at BS/2, and Denis Kokhaev, Head of the Business Technical Support Department of JSCB “Kapitalbank”, discussed it at the conference.

Experts presented details of the joint project for modernizing the ATM fleet in JSCB “Kapitalbank”, which includes Diebold Nixdorf DN Series devices with advanced software. With modern technology, more than 1.6 million bank customers will have convenient access to financial services.

Quick dispute resolution with ATMeye.iQᴺᴳ

ATMeye.iQᴺᴳ is BS/2’s flagship solution. This product fundamentally transforms how users perceive modern self-service devices. The solution helps financial institutions improve customer service quality and increase bank employee productivity.

ATMeye.iQ New Generation was deployed in production in 2023. The product provides tools for quick dispute resolution with customers, increases security and speed of response to threats, and improves device monitoring.

The solution operates without third-party software. ATMeye.iQ records all stages of a transaction using photos and videos. Full reports are available for download by authorized users for easy analysis and monitoring. As a result, banks get a complete toolkit for compliance handling.

ATMeye.iQ also offers a flexible and adaptive approach to device fleet monitoring. Users can choose which events to monitor, as well as notification methods, such as Telegram messages, email, etc.

Effective decision-making processes in business

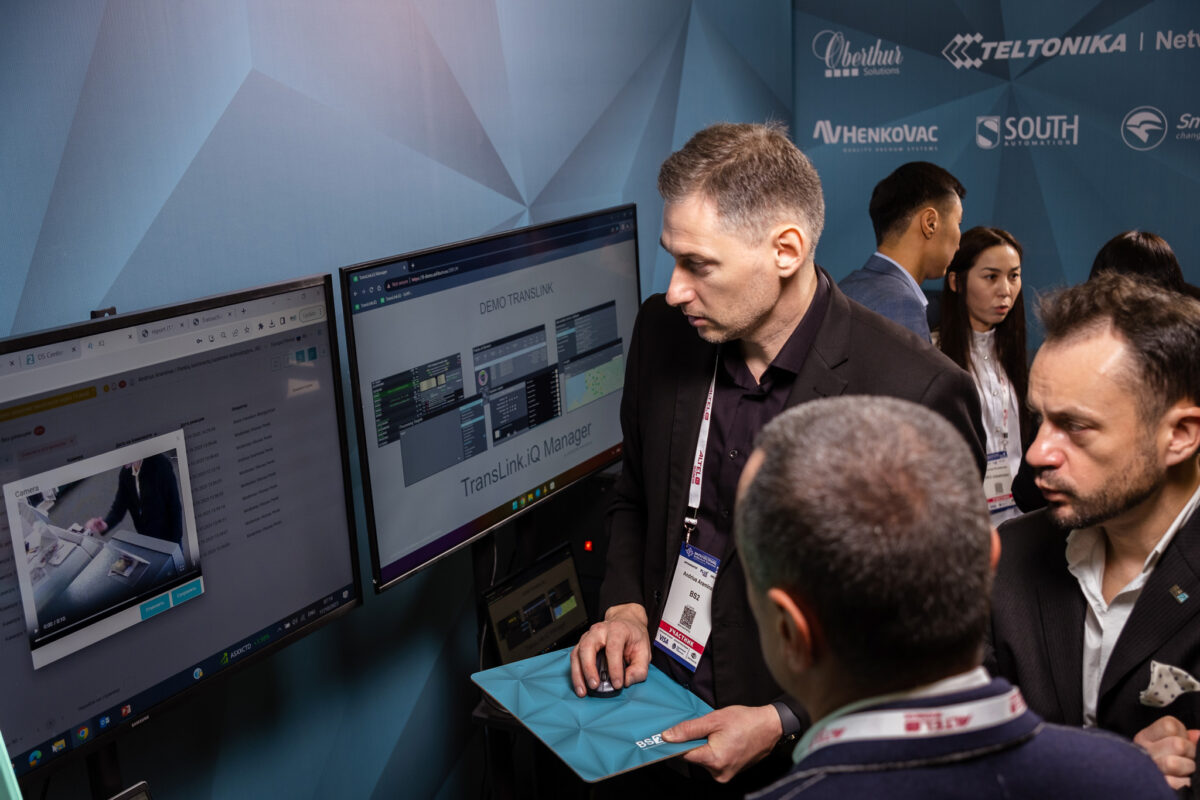

ATMeye.iQᴺᴳ and the new DS Center.iQ decision support system were demonstrated for the first time at the Forum in Almaty.

DS Center.iQ combines all information available on self-service devices (their technical condition, transaction activity, financial results, etc.). It allows users to access detailed information about self-service devices. Data integration with DS Center.iQ greatly simplifies information analysis and processing. By using the platform, managers at all levels are able to quickly draw the necessary conclusions and concentrate on making strategic decisions.

Additional functionality for secure data storage

The new version of ATMeye.iQᴺᴳ allows ATM data synchronization with the server. This feature automates the process of collecting and storing log files containing information about ATM transactions.

Log files, photos, and videos for each transaction can now be automatically uploaded to the server. Consequently, sensitive information can be saved even if an ATM failure occurs due to the synchronization feature.

The ATMeye.iQᴺᴳ platform continues to evolve, providing customers with enhanced functionality. The software is installed on 97 000 devices worldwide. The customer dispute resolution and security tool is successfully used by banks in Europe, the Middle East, the US, Asia, and Africa.

If you are interested in learning more about ATMeye.iQᴺᴳ and how it can help your company, sign up for a demo here.