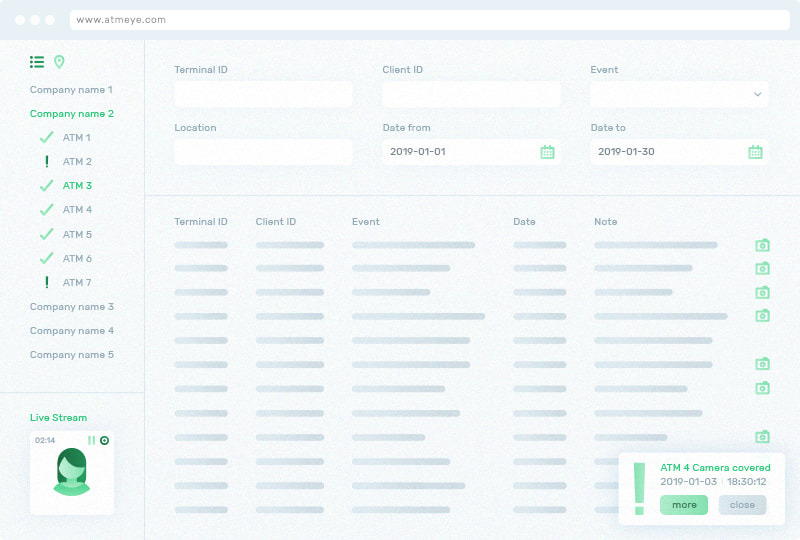

A proactive ATM video surveillance system

Ease the work of the security officer or ATM manager with event-based alerts and pre-set scenarios. These configurable scenarios run automatically with trigger-based ATM security. This feature helps stop fraud at ATMs and prevents the use of stolen or blacklisted cards